- Review: found

Review of 'Higher cost of finance exacerbates a climate investment trap in developing economies'

2023-03-12

IVAYLO ANGELOV3

Higher cost of finance exacerbates a climate investment trap in developing economiesCrossrefScienceOpen

Developing economies impacted from the vital green transition

Average rating: | Rated 3 of 5. |

Level of importance: | Rated 3 of 5. |

Level of validity: | Rated 3 of 5. |

Level of completeness: | Rated 3 of 5. |

Level of comprehensibility: | Rated 3 of 5. |

Competing interests: | None |

Reviewed article

- Record: found

- Abstract: found

- Article: found

Higher cost of finance exacerbates a climate investment trap in developing economies

Nadia Ameli, Olivier Dessens, Matthew Winning … (2021)

Review information

Review text

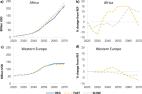

The study shows how different assumptions about the weighted average cost of capital can disproportionately impact decarbonization pathways for developing economies. The article also suggests policy interventions that could lower WACC values for low-carbon and high-carbon technologies, potentially allowing Africa to reach net-zero emissions 10 years earlier. The article raises important concerns about the current finance frameworks and the need for radical changes to ensure equitable distribution of capital. Overall, the article presents a well-researched and informative study that makes an important contribution to the ongoing debate on climate change and sustainable finance.

Comments

Comment on this review

Version and Review History